BizPro

BizPro is a leading transactions monitoring tool solution for the monitoring of commodity markets and the detection of suspicious market abuse conducts.

Several leading energy companies already rely on it.

BizPro is able to detect MAR and REMIT market abuse practices through 24 specific algorithms working on DAM auction markets (EPEX, GME&PCE) and continuous trading markets on more than 10 Exchanges and 25 Brokers including DMA activities (Trayport, ICE POF, EPEX M7/XBID, ETRM).

Each trade surveillance rule in BizPro applies to every single product traded during the day and analyses all orders and trades by all market participants.

The tool provides an “end-to-end” automated process from data source to reporting and case management workflow.

BizPro includes extensive interactive data analytics tools for continuous and auction data visualization, download and drill-down, allowing the analysis of suspicious market abuse behaviours in the overall market context.

The Advantages of Bizpro

BizPro is a strong related product which thanks to its 4 unique advantages it could be considered one of the best products for the dedicated market.

The Advantages of Bizpro

BizPro is a strong related product which thanks to its 4 unique advantages it could be considered one of the best products for the dedicated market.

Get involved in the Commodity Trading Network

BizPro is not just a Tool, it’s a network of companies and professionals in the energy and utilities sector that shares information and suggestions related to the market, according to the benchmark of European best practices.

By choosing BizPro for your business you will have access to periodic training courses sessions focused on market abuse, organized with all our customers to share and exchange insights, tips and real case studies always with the technical support of expert consultants ready to help your business within every criticality.

Abusive patterns inpected through dedicated algorithms

Reporting & Data Analytics

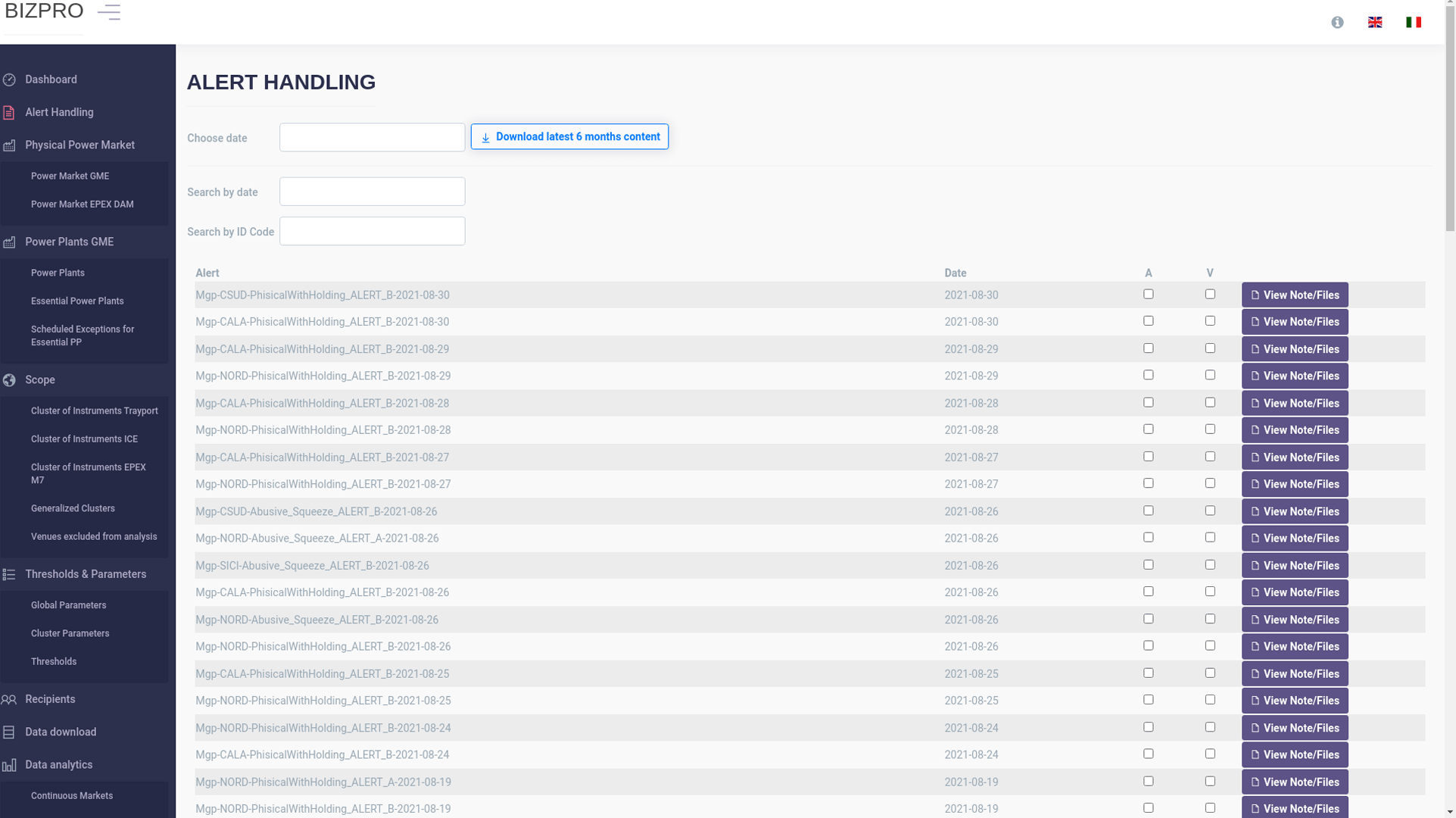

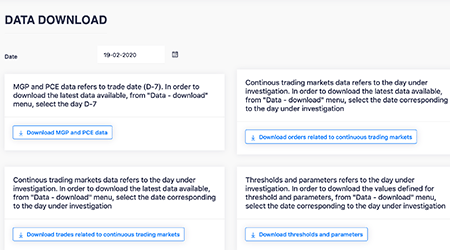

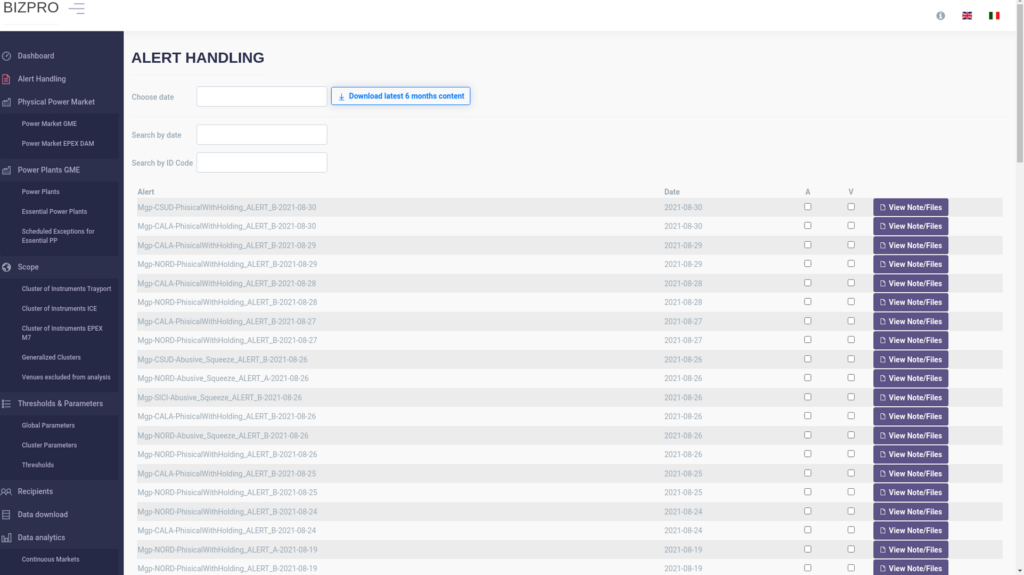

BizPro daily processes all orders and trades by all market participants, applying each surveillance rule to every single product traded during the day. The objective of these analysis is the detection of potential abusive conducts, as defined in MAR and REMIT Regulations.

In case of suspicious behavior detection, the software generates specific alerts, creates the related .pdf reports and notifies them by e-mail. Alert reporting is designed in order to provide all the information about the potential manipulation practice identified by BizPro.

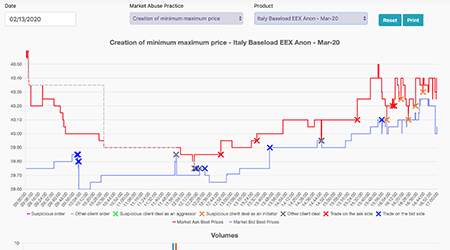

BizPro web interface also provides the user with extensive interactive data analytics tools for market data drill-down and alert investigation, allowing the analysis of suspicious trading behavior in the overall market context.

Each alert generated as a result of the monitoring activity, must be investigated in order to understand its underlying causes. The software interface includes a section dedicated to alert management and provides graphic representations of alerts generated for each manipulative pattern.

Reporting & Data Analytics

BizPro daily processes all orders and trades by all market participants, applying each surveillance rule to every single product traded during the day.

The objective of these analysis is the detection of potential abusive conducts, as defined in MAR and REMIT Regulations.

In case of suspicious behavior detection, the software generates specific alerts, creates the related .pdf reports and notifies them by e-mail.

Alert reporting is designed in order to provide all the information about the potential manipulation practice identified by BizPro.

BizPro web interface also provides the user with extensive interactive data analytics tools for market data drill-down and alert investigation, allowing the analysis of suspicious trading behavior in the overall market context.

Each alert generated as a result of the monitoring activity, must be investigated in order to understand its underlying causes.

The software interface includes a section dedicated to alert management and provides graphic representations of alerts generated for each manipulative pattern.

Infographic

Download BizPro Infographic to learn more about how the software works.